The new year is a time for a fresh start, and hopefully new business growth opportunities. While your business may be positioned for big growth, is it prepared?

Choosing the right opportunity can make or break business growth.

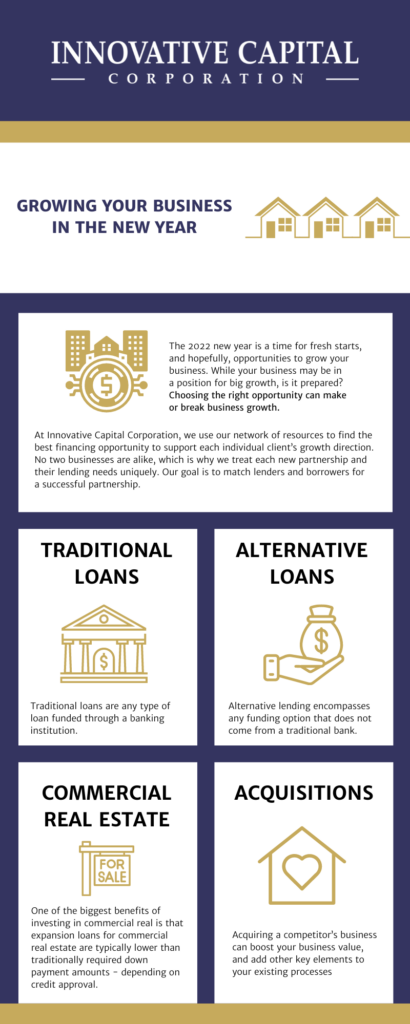

At Innovative Capital Corporation, we use our network of resources to find the best financing opportunity to support each individual client’s growth direction. No two businesses are alike, which is why we treat each new partnership and their lending needs uniquely. Our goal is to match lenders and borrowers for a successful partnership.

Read on to learn the three different options we recommend to start your business on the right foot this new year. Let’s dive in.

Funding Growth Through Traditional and Alternative Loans

When considering different financial options for business growth, traditional and alternative loan options may be the first thing you think of before any other lending option. Before applying for a business loan, consider these five steps to put your business in the most ideal position to secure the best rate and terms for your unique needs:

- Get organized and prepared

- Maintain good credit

- Choose the right loan type for your needs

- Know how much money you need

- Have sufficient cash flow

Traditional loans are any type of loan funded through a traditional banking institution. Alternative lending encompasses any funding option that does not come from a traditional bank. They are known to have simpler application processes, greater flexibility, and faster turnaround times than traditional loans.

Some alternative lending options include:

- Hard money loans- typically funded by private investors and are associated with shorter terms and higher interest rates.

- Line of credit- this option acts similarly to a credit card associated with a higher loan amount.

- Crowdfunding- also known as peer lending because the loan is financed from multiple sources instead of one.

- Bridge loan- This is a short-term loan intended to fund a project through personal collateral. They are associated with high-interest rates but have quicker application and underwriting processes.

- Asset-based loan- Borrowers can use assets such as property or inventory to secure a loan instead of a credit score.

Growing Physically Through Commercial Real Estate

Another option to promote business growth in the new year is through commercial real estate. One major benefit of investing in commercial real estate is that expansion loans for commercial real estate are typically lower than traditional down payment requirements – depending on credit approval.

Established business owners are not required to contribute large portions of cash before purchasing a commercial property, which allows that same money to be reallocated into the business itself. Commercial real estate investments open your business to the benefits of growing physically, financially, efficiently, and boosting a consumer base as you grow your footprint.

The best strategy to ensure your business’ physical growth through commercial real estate is successful is by:

- Knowing where your customers’ increasing consumption patterns reside. This helps you identify what areas of your business need to grow.

- Know how your business will use funds for growth

- Have sufficient cash flow that will sustain your business while considering additional unforeseen costs.

Growing Through Acquisitions

Although this option might not be at the forefront of your business strategy, it could be a surprisingly beneficial choice. Acquiring a competitor’s business can boost your business value, and add other key elements to your existing processes such as:

- Expanding product lines into new markets

- Become more competitive

- Increase business skill sets

- Gaining vendor discounts

- Gaining market share

- Cross-selling

- Increasing geographical footprint

In some cases, acquisitions do not require placing equity in the transaction.

Do you know how to find the right financing option?

Kick-off the new year with the security of knowing your business is choosing the right funding option for growth. Our team at Innovative Capital Corporation is fully equipped to partner with you to find the funding option that fits your business. To understand more about business loans and how to calculate them, click here.