Not all loans are predatory loans. There are multiple alternative lending resources borrowers can use that benefit both lender and borrower. However, understanding predatory lending, the warning signs, and how to avoid it when sourcing a loan can help you avoid falling prey to a predatory loan.

The key is sourcing options and working with a trusted partner. Read on to learn more about debunking the myth of predatory lending in the alternative lending sector, especially with hard money loans.

What is predatory lending?

Predatory lending is referred to as any type of lending practice that is:

- Unfair

- Abuses loan terms for borrowers

- Deceptive

These loans benefit the lender, not the borrower because they are associated with high fees, high interest rates, are more expensive, and they do not give the borrower adequate equity in the loan.

It typically targets minority groups, people in need of quick loans for health or monthly expenses, people without proper loan understanding, and the poor. African American and Latinx communities are most affected by predatory lending.

Predatory lenders are not transparent with their borrowers. Their tactics are deceptive, fraudulent, persistent, aggressive, and non transparent to push borrowers to take out loans they cannot. Oftentimes, borrowers fall prey to predatory lending loans because of limited loan opportunities due to low credit, the need for a quick loan, discrimination or lack of loan knowledge.

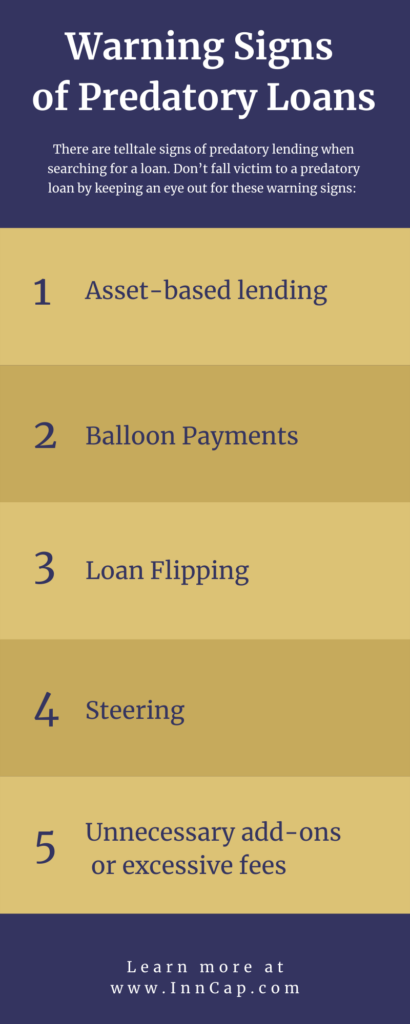

What are the warning signs of predatory lending?

There are telltale signs of predatory lending when searching for a loan. Don’t fall victim to a predatory loan, and keep an eye out for these warning signs:

- Excessive fees that have nothing to do with the loan itself.

- Loan Flipping- the lender pushes the borrower to continuously cycle taking out loans at higher interest rates that increase debt.

- Reverse redlining- The Fair Housing Act of 1968 banned redlining, a housing policy that banned Black families from receiving mortgages, and predatory lenders typically target communities that were redlined.

- Steering- predatory lenders try to steer borrowers into more expensive loans they cannot afford.

- Unnecessary add ons- Predatory lenders will push borrowers to purchase more loan products the borrower doesn’t actually need

How to avoid predatory lending

The best ways to avoid predatory lending are by:

- Working with a trusted partner

- Learning about different types of loans, and the type of loan you might need

- Shop different loan opportunities

Our team at Innovative Capital Corporation focuses on client-centered lending to find the best loan for our client’s unique capital needs. We source your loan to our network of resources and leverage their offers to find you the best rate and term.

We understand that when clients need funding, they often have limited visibility of their options. We have the alternative lending resources to expand our clients’ scope of options, and fund their needs transparently, ethically, fairly, on their terms.

Working with us gives you back the power of negotiation and the option to choose which offer is best for you because we connect your business with financing experts who find multiple options.

Are Hard Money Loans Predatory?

Hard money loans are also referred to as private capital because they are funded by private individuals. They are commonly secured by physical assets instead of credit. Hard money loans are not predatory when sourcing with a trusted referral partner with your best interest in mind.

Since hard money loans are typically negotiated between lender and borrower, it’s important to understand the full scope of the terms before signing the loan. Working with a trusted partner, like our team at InnCap, can help guide you through the process of hard money lending. Our expert team saves you from falling trap to a predatory loan, and ensures we source you the best deal.

Curious about the different types of funding options available? Read our article on Private Equity vs. Debt Funding here.