Flipping houses has been around for years and has become increasingly popular to generate income through real estate investments.

Some buyers seek turnkey homes, apartments, offices, and commercial spaces that are updated and with modern finishings. This demand creates a lucrative opportunity for those willing to invest time and capital upfront for potential profit.

What is Fix and Flip Real Estate?

Fix and flip real estate refers to the art of intentionally buying a property and fixing it up so you can sell it for a profit. Fix and flip homes can range from single-family homes to multi-unit properties, and commercial or industrial properties.

Other common terms used to describe “fix and flip” include “rehab,” “rehabbing a home,” “flipping houses,” or “fixer-upper.”

Are Fix and Flips Profitable?

Taking advantage of a property to do a fix and flip could generate a healthy profit after renovations.

If you are looking to do a fix and flip, you will want to seek properties that are in need of fixing up but also show signs of profitability.

This article from Upnest recommends avoiding properties that would require costly repairs or have major structural damage, for example. Do your research on the location, property type, costs for repairs and renovations needed, and other essentials ahead of time.

How Does Fix and Flip Real Estate Work?

The fix and flip process typically starts with finding a property that is in need of repair or renovation. This property can be found through a real estate agent or through a direct sale from the owner.

Once the property is purchased, the investor will make the necessary repairs and improvements to increase its value. The property is then listed for sale, and if all goes well, it will sell for a profit.

How to Fund Your Fix and Flip Project

There are several options available for funding a fix and flip project, including cash, private lending, and traditional bank loans.

For those who do not have the cash to invest, the first option most consider is getting a traditional bank loan. With banks tightening up their loan offerings post-pandemic, however, it is not as easy or simple to secure a loan from the bank as it used to be.

Alternative lending, including private lending, can be a great option to find a loan for your fix and flip project so you can fund the purchase of the property, renovations, and other costs associated with it prior to selling.

How Innovative Capital Can Help Support Fix and Flip Projects

Innovative Capital is a trusted source to help connect you with the right lender and loan type to suit your specific needs for your fix and flip loan.

Our team of experienced professionals is dedicated to helping our clients succeed by providing them with the type of loan they need to purchase, renovate, and sell their fix and flips.

We can help you shop multiple lenders in our network to find the right loan, or we can leverage private capital to help provide a solution when a deal is considered “un-bankable.”

Through the extensive knowledge and experience of our team, we provide a strategic and varied outlook on the best solution – and we only earn our fee when we perform and provide a loan that you choose as your best option.

We have a large, varied list of connections with many types of lending sources, including private capital.

We broker thousands of loans every year, many of which are real estate loans and for fix and flip properties. See our current market rates and view our Recently Funded page for examples of clients we have worked with.

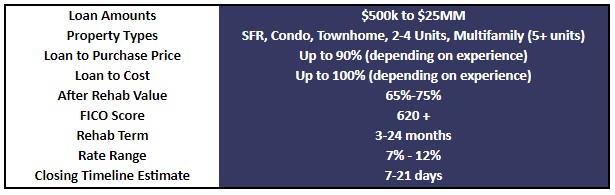

View our financing guidelines for fix and flip projects below:

Get in touch with one of our team members for more information on securing a loan for your specific needs today. Request a quote here and we will get back to you shortly.