Zillow, based in Seattle, Washington, is a leading online real estate marketplace company. Their website allows you to find resources to:

- Buy, rent, and sell homes

- Find home loans

- Find real estate agents or property owners

An additional feature is their Zestimate® feature. This tool gives estimated property valuations thanks to Artificial Intelligence (AI), calculating the estimated sales price of a property by weighing the facts provided by homeowners and looking at comparables.

The challenge when using AI, however, lies within an unpredictable, ever-changing market for expensive, real-world purchases. The capabilities of AI to provide an accurate valuation of properties don’t always exceed the quick capabilities of a seasoned real estate agent.

Zestimates real estate estimations have a margin of error of 1.9%- 6.9%.

About three and a half years ago, the company began its Zillow Offers program to purchase homes from owners, renovate them, and resell them to turn a profit. In February 2021, Zillow launched an added feature to the program that sent an initial offer from the company to purchase homes.

After eight months of this new feature, in early November, the company announced they were shutting down the Zillow Offers program, and as a result, offloading their 7,000 intended fix and flip homes. Read on to learn what this means for commercial real estate investors.

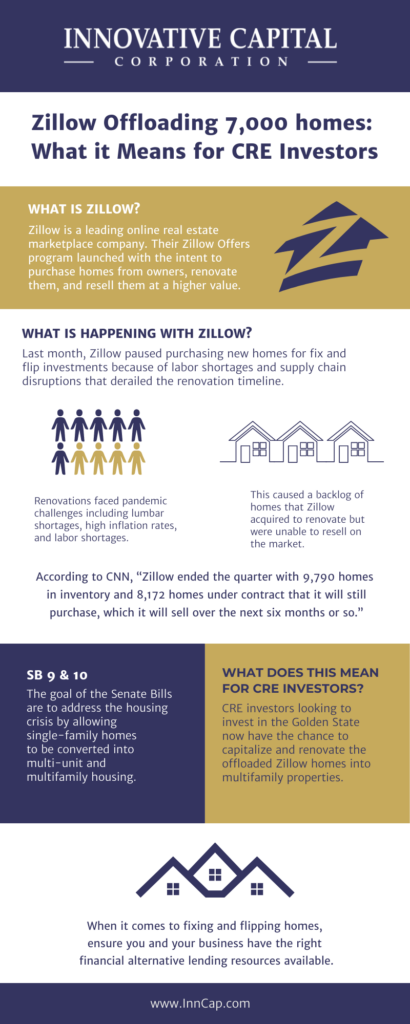

What Is Happening With Zillow?

Last month, Zillow paused purchasing new homes for fix and flip investments because of labor shortages and supply chain disruptions that derailed the renovation timeline.

Renovations faced pandemic challenges including lumbar shortages, high inflation rates, and labor shortages. This caused a backlog of homes that Zillow acquired to renovate but was unable to resell on the market.

Simultaneously, Zillow faced a growing competitive market during the pandemic as housing market prices soared and homes were sold well above market value. The company found that only 10% of their Zillow Offers made were actually accepted.

According to CNN, “Zillow ended the quarter with 9,790 homes in inventory and 8,172 homes under contract that it will still purchase, which it will sell over the next six months or so.”

Now, a plan that was originally created as an investment opportunity marketed to the public as a way to conveniently sell a home while minimizing transactions has turned into an overstock of unrenovated homes that will lose the company millions of dollars and thousands of jobs.

With the Zillow Offers program permanently shut down, “the real estate listing company took a $304 million inventory write-down in the third quarter, which it blamed on having recently purchased homes for prices that are higher than it thinks it can sell them. The company saw its stock plunge and it now plans to cut 2,000 jobs, or 25% of its staff,” according to CNN Business.

Zillow spokesperson Viet Shelton explained further: “The challenge we faced in Zillow Offers was the ability to accurately forecast the future price of inventory three to six months out, in a market where there were larger and more rapid changes in home values than ever before.”

As the company offloads its overstock of homes, they are seeking to make $2.8 billion.

What Does This Mean for CRE Investors?

The opportunity to purchase overstock homes holds an investment opportunity for CRE investors. With the recent passing of SB 9 and 10 in California, CRE investors looking to invest in the Golden State have the chance to capitalize and renovate the offloaded Zillow homes into multifamily properties.

With the right renovation, these homes have the potential to become multifamily properties in the CRE industry.

What Are SB 9/10?

Senate Bill 9 and 10 were signed by California’s Governor Gavin Newsome this September. The goals of the Senate Bills are to address the housing crisis by allowing single-family homes to be converted into multi-unit and multifamily housing.

With SB9, zoning regulations have been eliminated for single-family homes. Mercury News explains that property owners can now “split a single-family lot into two lots, add a second home to their lot or split their lot into two and place duplexes on each.”

Consider Your Options

When it comes to fix and flip homes, ensure you and your business have the right financial resources to fund your next capital venture. Commercial real estate investors looking into purchasing one of the offloaded Zillow homes should consider the various loans or alternative lending options available to support these projects.

Read our article on your guide to fix and flip loans to learn about the best lending option for your next venture.